Construction is the largest industry in the global economy, accounting for 13 percent of the world’s GDP. But its performance is lacking. Productivity hasn’t improved in over 20 years. Fortunately, there is a new era coming.

According to a study by McKinsey, we can expect nine shifts that will radically change the way construction is done. Companies that can adjust their business models stand to benefit handsomely, while others may struggle to survive. One of those nine? Shifting to a product-based approach.

Significant changes that are shaking up the construction market today:

Persistent cost pressure from tight public budgets and housing affordability concerns

Increasing need for adaptable structures

Increasing owner and customer sophistication

Evolving customer needs and greater focus on total cost of ownership

Increasing complexity of projects

Higher demand for simplified and digital interactions

Increasing sustainability requirements and demands for safety performance

Persistent scarcity of skilled labour

Changing logistics equation resulting from new materials and modules

Stricter regulation on safety and sustainability

Changing regulations and incentives for modern methods, enabling more standardization

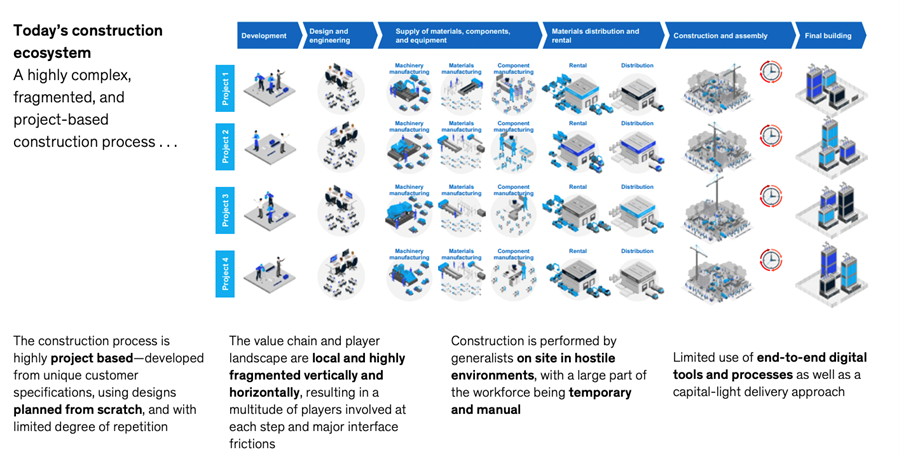

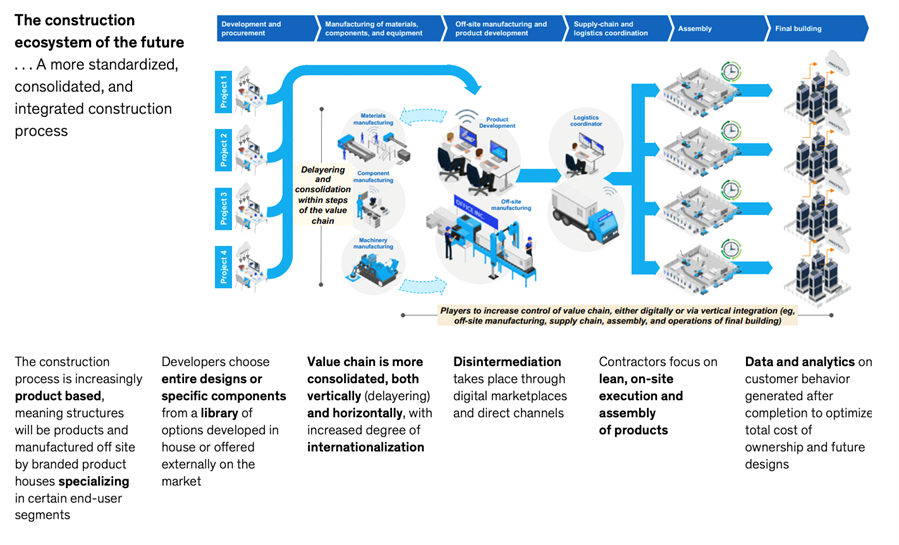

How will the future construction ecosystem look? Radically different!

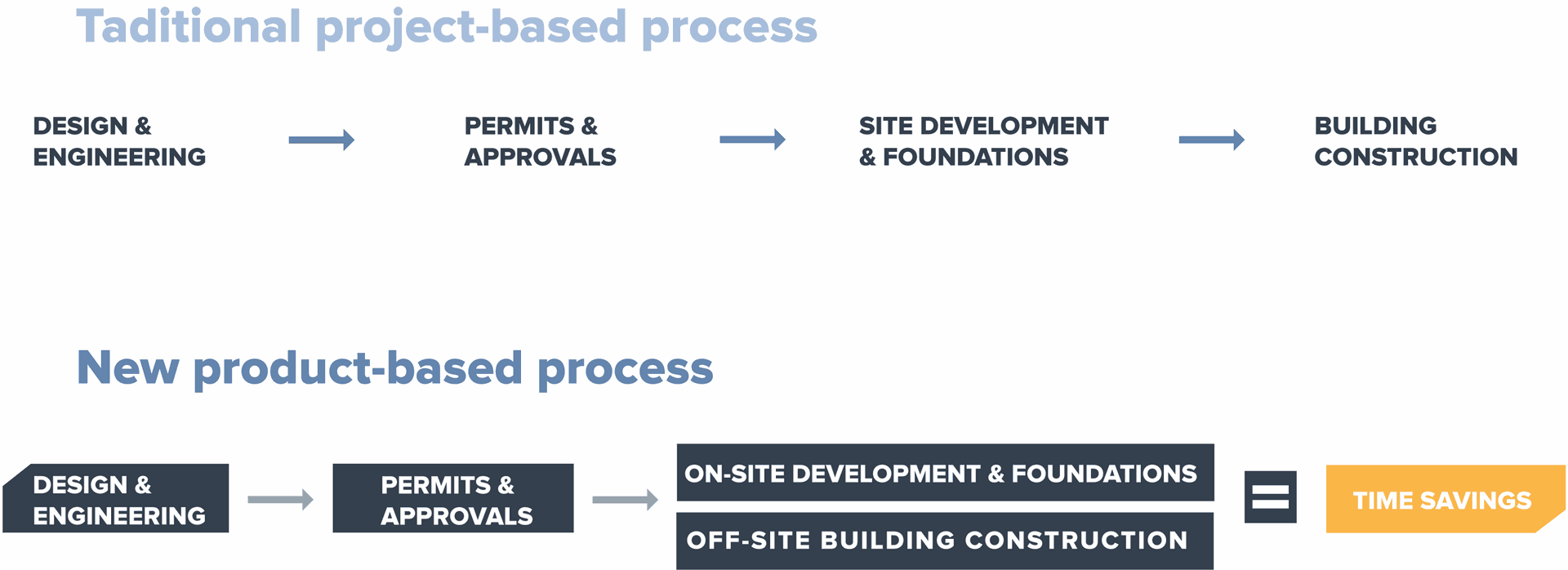

From project-based to product-based construction

The construction process is expected to undertake a radical shift toward an industrialized setup by moving from a project- to a product-based approach. A large share of construction projects will be built using customizable, modularized components produced by standardized processes in off-site factories.

The modules and elements will be shipped and assembled on site.

Production will consist of assembly line-like processes in safe, nonhostile environments with a large degree of repeatability.

Industry-wide standards for elements and components may emerge.

There will likely be a balance between simple components (manufactured according to industry-wide standards) and tailored, customizable ones to fit customer needs.

Each player will develop its own design library of elements and components that can be assembled according to customer requirements.

A portion of the market might be composed of prefinished volumetric modules, and customizable, LEGO-like, modular components could become the industry standard.

The creativity in designing bespoke products will remain—developers and product manufacturers will collaborate to design products according to unique circumstances.

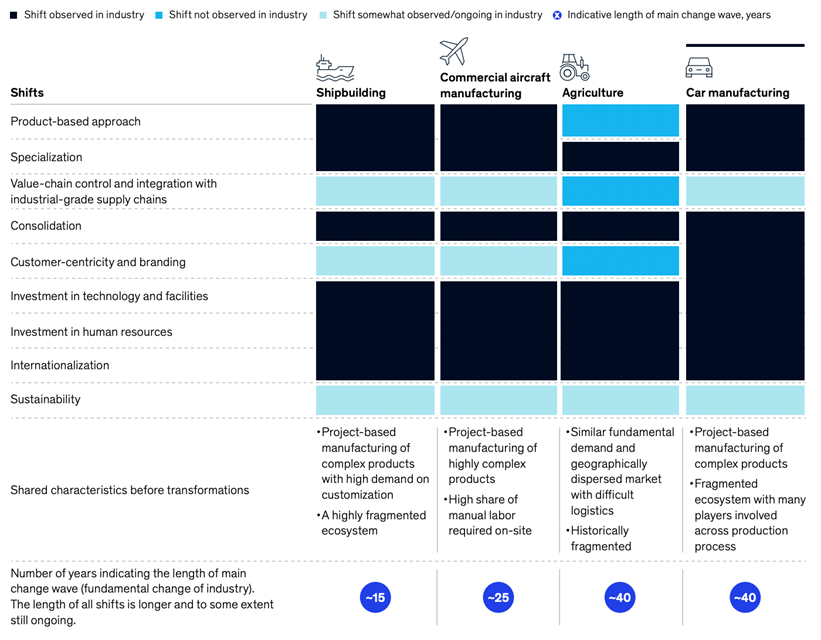

Hi, car factory? Yes, these shifts have already occurred in similar industries.

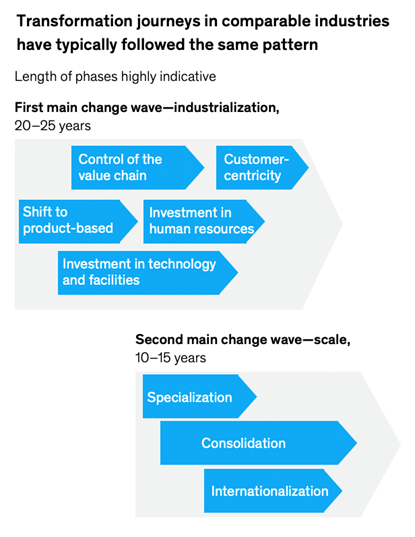

In shipbuilding, aircraft and car manufacturing, players shifted to a product-based approach. The most famous example is Ford’s innovation of the assembly-line manufacturing process. Most of the auto-manufacturing industry adopted the process within ten years. In this model, prefabricated and modularized subcomponents are inputs, and ships, airplanes, and cars are outputs.

“Across industries, winners continue to heavily invest in technology, many with a focus on digitalization and data-driven products and services.”

While the manufacturing process was significantly standardized, products remained customizable. When early movers boosted their productivity and profit margins, competitors adopted the innovation over time. Toyota’s further innovations, like lean manufacturing and use of robotics, boosted the company from a small player to one of the largest in the industry.

When will the shift to product-based happen? Let's give it 5 years.

Many players believe that the construction industry is ripe for disruption. The full transformation will take time. However, the process has already begun. The industry leaders who responded to the McKinsey survey largely agree that:

the shifts are likely to occur at scale within the next five to ten years.

the need for drastic change is greater today than it was five to ten years ago.

the industry will look radically different in 20 years.

Disruption has started to occur at scale. Both incumbent players and emerging start-ups (hey, that’s us!) have been pushing for changes in the industry. While similar transformation journeys have taken decades in other industries, construction could harness new digital technologies to speed up its process.

77% of the respondents believe that a shift to product-based is likely to occur at scale and will take place in the next five years.

While prefabrication and modularization have been present in construction for a long time, they have only recently started to regain traction with new materials, better quality, and more design flexibility. Modular construction offers several advantages over traditional methods:

It reduces the need for labor (an appealing benefit in markets facing labor shortages)

It reduces costs

It decreases construction timelines by 30 to 50 percent.

What are some expected consequences for a product-based approach?

The industry cannot change in isolation. Change must be a joint effort by all players in the ecosystem and those they interact with. They must prepare now for a fundamentally different next normal.

Consolidation throughout the industry is key

Growing needs for specialization and investments in innovation—new materials, digitalization, technology and facilities, human resources—will require significantly larger scale than today. As product-based approaches further increase the importance of gaining scale, with higher standardization and repeatability, the industry is likely to increasingly see a significant degree of consolidation, both within specific parts of the value chain and across the value chain.

Disruption could fundamentally change what it means to be an engineer or an architect

Historically, these professionals have applied their expertise to create designs for an individual project’s unique requirements. The coming years will see them closely collaborating with productized and branded developers, off-site construction firms, and specialized contractors as an integrated R&D-like function.

They will add value through the standardization of structure and subsystem designs and develop standardized design libraries of products in their target segments.

This modular design will be reused across a large set of construction projects.

In this way, design and engineering firms could influence industry standards.

As the industry shifts, the challenge for engineering and architecture firms will be to retrain their existing workforces and hire the right talent.

Digital technologies will be a critical factor in the shift

Companies that own the digital model will be able to control the process without actually owning any factories and to price products based on TCO rather than using today’s simple cost-plus approach.

The shifts are expected to positively shape future demand for offsite construction

Overall, off-site construction is still relatively young, with high fragmentation, smaller-scale players and mostly manual labor. Led by a product-based approach, standardization, and sustainability, the coming years will see a shift to manufacturing a broad range of products off site, on a manual or automated production line.

Deeper integration in flat-pack design such as doors, windows, and fully preinstalled mechanical, electrical, and plumbing systems.

Data will be flexibly transferred from BIM models to the automated factory controls for customization within standard designs.

The level of integration and connector technology aims to require no skilled labor on the final site and enable extremely fast building times.

There will be a mix of flat-pack (2-D) and volumetric (3-D) preconstruction.

Through close collaboration with designers or integrated R&D departments, companies will build standardized libraries of subsystems that allow mass customization.

Owners and financial institutions need to support change

Historically, owners have opted for customized solutions, but some level of standardization is necessary for the future ecosystem to be viable. Owners must embrace new, more modular approaches to design. Such a shift would not be altruistic. Owners will reap multiple benefits in the future ecosystem.

The future of construction also requires new financing solutions as well as a willingness to change the risk profile of investments. This also holds true for other closely linked institutions such as insurance companies, where some are already factoring use of modern methods of construction into their terms.

source: