Through the Paris Agreement, Belgium has committed to achieving net-zero emissions of greenhouse gases by 2050. Because of its dense population and industrialized economy, our country’s emissions per capita are among the most intensive in Europe (ranked 7th in CO2 per capita out of 27 EU countries).

With their latest report, McKinsey & Company provides an in-depth analysis of Belgium’s potential to achieve that goal and pursue green growth. It examines the actions and significant investments that are needed across sectors for Belgium to address and overcome these challenges. At the same time, it looks at the significant business opportunities that the global net-zero transition could create for Belgian companies and the economy more broadly.

As we are very invested in the part construction can play in this green goal, we rounded up the key takeaways from the report about the built environment. Let’s have a look!

A Belgian pathway to net zero energy: increase domestic energy supply

Belgium could experience a significant reduction in energy dependency from foreign countries: today, Belgium supplies only 5 percent of its domestic energy needs but could become up to 50 percent self-sufficient if it were to follow the net-zero pathway as modelled in the report. By growing the use of renewable energy sources through a maximized build-out of solar and wind production capacity and implementing new energy-efficiency measures.

Which changes are needed for the built environment to get on that path?

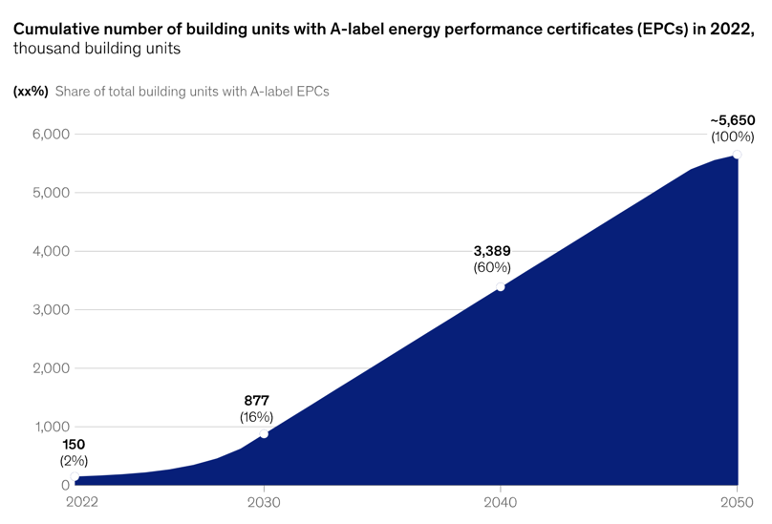

For buildings, to achieve net zero, new buildings and nearly all existing building units (5.5 million out of a total 5.7 million) will need to evolve toward an A-label energy performance certification. This would require a combination of deep energy retrofits, rebuilds, and new builds.

Deep energy retrofits result in a reduction of energy consumption of more than 60 percent or contribute to achieving A-label certification. This could be achieved through better insulation and by switching from fossil-energy sources to heat pump technology and district heating. This is a major undertaking because Belgian buildings tend to be larger, older, and less insulated than the stock of buildings in some other European countries, and its dense, historical city centres add to the complexity of this undertaking.

Main drivers of 2030 reduction for the building sector

- Around 30+% of building units are highly insulated

- Around 20% of buildings equipped with a heat pump

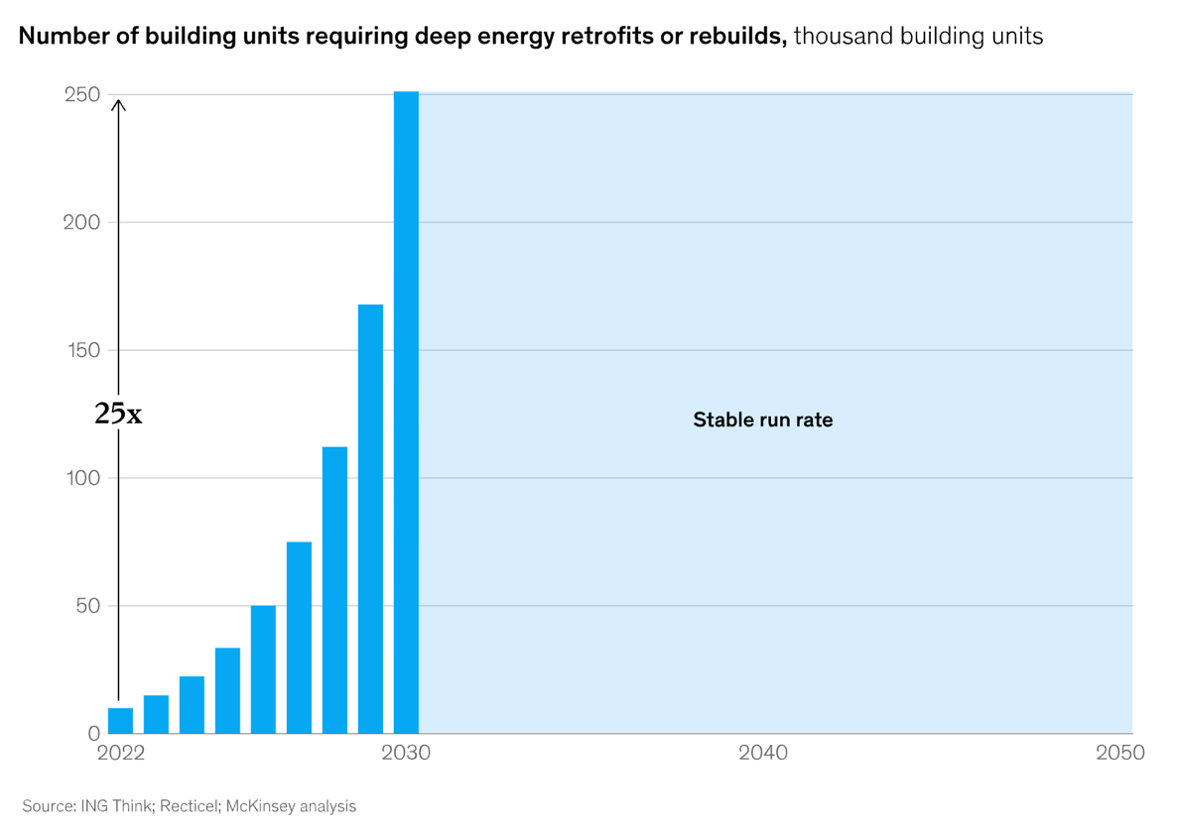

The total energy retrofit market could double in size, while the pace of the deep energy retrofits needed to achieve an A-label certification would have to increase 25-fold by 2030, from about 10,000 building units per year today to 250,000. This would lead to a massive increase in demand for building materials and human resources. Moreover, innovation would be required to develop greener, more-productive, less-invasive, and more-affordable materials and construction methods. Training and education will also need to be adapted as of today.

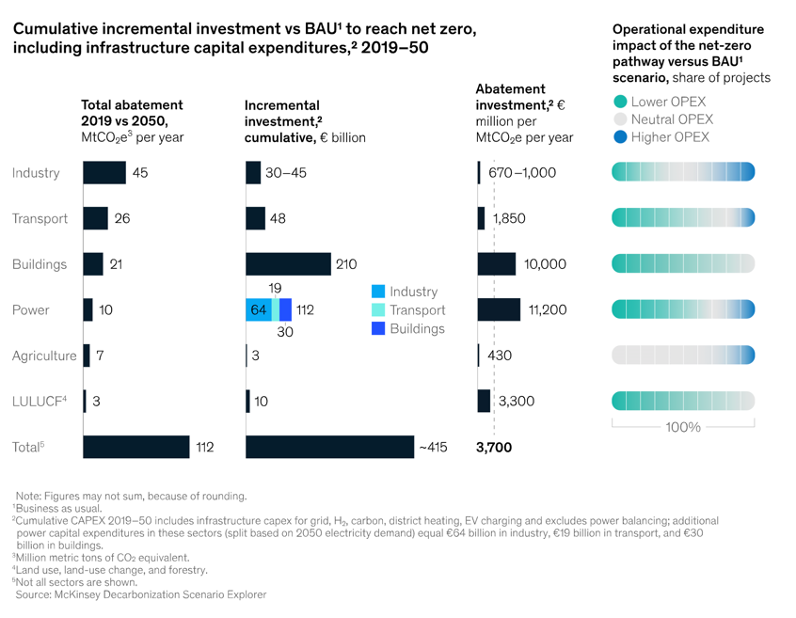

“Reaching net zero will require a cumulative incremental investment of about € 415 billion, mostly to decarbonize buildings and power”

- Given the size of the incremental investment needed in buildings, including residential housing, about 45 percent of the total incremental spending would be borne by households; consumers would also carry some of the investment cost of the power and transportation transitions.

- Businesses would carry about 40 percent of the investment across sectors.

- And investments by central infrastructure providers in power, transport, and industry would make up the remaining 15 percent.

The action point for buildings: transitioning households to energy-efficient and lower-emissions residences

McKinsey defined 5 main action points on the path to net zero. One of those is transitioning Belgian households to energy-efficient and lower-emissions buildings in an affordable and feasible way. The challenge is twofold: first, the extent of the necessary retrofitting, rebuilding, and new building; and second, the substantial household investment associated with retrofitting, rebuilding, or new building.

Various tools could help set this transition into motion:

- Commercializing new technologies, such as heat pumps, at an affordable price.

- Providing long-term green loans for rebuilds and energy-efficient retrofits, including adding insulation.

- Supporting strong regulatory mechanisms and incentives to ensure rapid and comprehensive rebuilds, as well as retrofitting that is affordable for Belgian households.

- Contractor capacity would also have to increase, implying a massive HR and training challenge.

Accelerating deep energy retrofits by 25 times is needed to ensure the total building stock achieves A-label energy performance certificates by 2050.

Seizing opportunities for green growth: invest in deep energy retrofits

The global sustainability transition offers green growth opportunities, including for Belgian players. While the scale of Belgium’s sustainability transition may seem daunting, the country also has the potential to tap new sources of green growth. For buildings, this means developing service models for deep energy retrofits of buildings.

Buildings in other European countries, not just Belgium, will also need to undergo major retrofitting, rebuilding, or new building to achieve net-zero targets, raising the prospect of a new growth sector specializing in buildings retrofits and rebuilds. In Belgium alone, the retrofit potential under the net-zero pathway represents a cumulative €400 billion investment pool between 2023 and 2050 (of which €210 billion is incremental)—about €16 billion annually from 2030 to 2050. This represents an opportunity for companies, especially early movers, to develop service offerings that address these new market needs.

To recap the key takeaways from the McKinsey report for buildings

- 240 million building units in Europe (of which 5.5 million in Belgium) will need a combination of energy retrofit and rebuilding to reach 2050 net-zero ambitions.

- An orderly decarbonization will be challenging because of the complexity of the stakeholders landscape. Stakeholders have to decide quickly about changes needed and investments in new technologies.

- Increasing insulation is a prerequisite for decarbonizing Belgian buildings and could reduce the country’s heating needs by more than 2,5 times by 2050.

- Transitioning Belgian households to energy-efficient and lower-emission buildings is one of the five most significant actions that will be needed.

- Shifting from fossil-fuel heating toward electrification, biofuels, and district heating will be critical for decarbonization of the building stock.

- Accelerating deep energy retrofits by 25 times is needed to ensure the total building stock achieves A-label energy performance certificates by 2050. From 10.000 to 250.000 units a year as fast as possible.

- The energy retrofit market will almost double in the European Union. From 210 billion annually to 380 billion by 2030. To put it in perspective, this is almost equal to the EV market in 2030.

- Flanders has imposed mandatory retrofit and is gradually raising performance targets to an A-label for buildings sold from 2040.

- Decisions on structural investments will need to be made quickly – within the next two years or so – given the lag between the decision to build capacity and the start of operations.